Great article about the economics of mixed-use development, something we’re always pushing here at Laurel Park Management. Mixed-use helps makes places walkable and livable. It helps make them better, more beautiful, and more vibrant. So, naturally, it provides an economic boon as well. What’s more, the study below was also performed in Sarasota:

Are cities across the country acting negligently in ignoring the property tax implications of different development types? Joseph Minicozzi thinks so, and he’s done the math to prove it.

The wisdom of man never yet contrived a system of taxation that would operate with perfect equality.

— Andrew Jackson

Downtown Pays

Asheville, North Carolina — like many cities and towns around the country — is hurting financially.

It’s not that Asheville is some kind of deserted ghost town. Rather, it’s a picturesque mountain city with a population of about 83,000 that draws tourists from all over the world, especially during the leaf-peeping season. But it’s also a city that appeals to its residents, who revel in strolling about a true walkable downtown chock-full of restaurants and retail shops featuring locally grown and crafted products. Downtown is not only one of Asheville’s main draws; it also serves as a major driver in helping the city overcome its budgetary doldrums.

Most of us – city planners, elected officials, business owners, voters, and the like – understand that the city brings in more tax revenue when people shop and eat out more. However, we often overlook the scale of the property tax payoff for encouraging dense mixed-use development.

Many policy decisions seem to create incentives for businesses and property developers to expand just about anywhere, without regard for the types of buildings they are erecting. In this article, I argue that the best return on investment for the public coffers comes when smart and sustainable development occurs downtown.

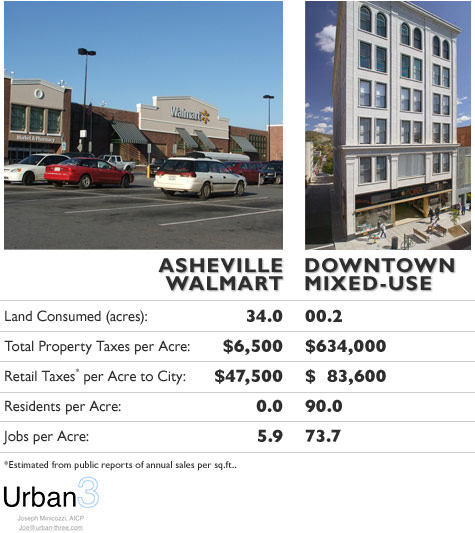

We’ll use the city of Asheville as an example. Asheville realizes an astounding +800 percent greater return on downtown mixed-use development projects on a per acre basis compared to when ground is broken near the city limits for a large single-use development like a Super Walmart. A typical acre of mixed-use downtown Asheville yields $360,000 more in tax revenue to city government than an acre of strip malls or big box stores.

If you were a mayor or city councillor facing a budget crisis, this comparison should serve as an eye-opener, both in terms of your policies and your development priorities. The comparison should also get you thinking about not just how you could encourage more downtown development, but also what kind of development could increase the value of buildings in the surrounding neighborhoods.

It’s not just officials in Asheville who should be asking these questions. In the growing number of diverse cities where we have studied this same equation (such as Billings, MT, Petaluma, CA, and Sarasota, FL) we’ve found that the same principle applies: downtown pays. It’s simple math. keep reading at planetizen.com